The Future of Startup Finance: From Spreadsheets to Intelligent Models

TL;DR

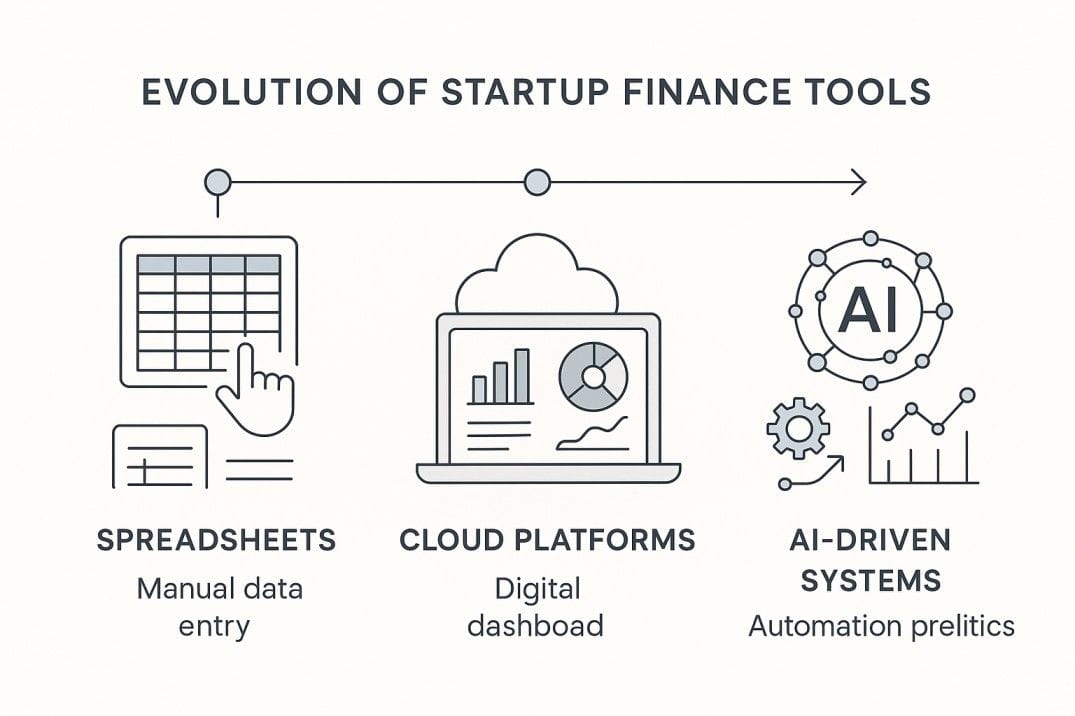

Thesis: Spreadsheet-based finance fails not because spreadsheets are bad, but because they were never designed to be decision systems for fast-growing companies.

Where the old way breaks

- Manual data handling creates delay, errors, and mistrust.

- Multiple versions destroy accountability and clarity.

- Finance teams spend more time fixing numbers than interpreting them.

- Decisions are made on stale or incomplete information.

The better approach

- Treat finance as a real-time intelligence layer, not a reporting task.

- Use connected systems as the source of truth, not files passed around.

- Automate repeatable mechanics; reserve judgement for humans.

- Build auditability and review into the workflow, not after the fact.

Outcome: Faster, safer decisions with fewer surprises and far less operational drag.

Introduction

Startup finance determines whether a company spots risk early or explains it late. Hiring plans, pricing decisions, runway calculations, and fundraising narratives all depend on what the numbers say and how quickly they surface.

Yet the reality is fragile. Commonly cited industry research suggests that around 40% of finance teams still process a large share of their data manually, and many spend 40 to 60% of their time simply collecting, cleaning, and reconciling numbers rather than analysing them. Separately, spreadsheet audits frequently report that the majority of complex financial models contain material errors, often due to broken formulas or outdated assumptions.

This matters because most startups still rely on spreadsheets as their primary finance system. Spreadsheets were designed as flexible calculation tools, not as shared, real-time decision infrastructure. As companies grow, that mismatch creates a quiet failure mode: decisions are made with delay, confidence erodes in the numbers, and risk accumulates invisibly. What looks like “business as usual” in finance often masks a growing strategic blind spot.

The core problem (what the old way gets wrong)

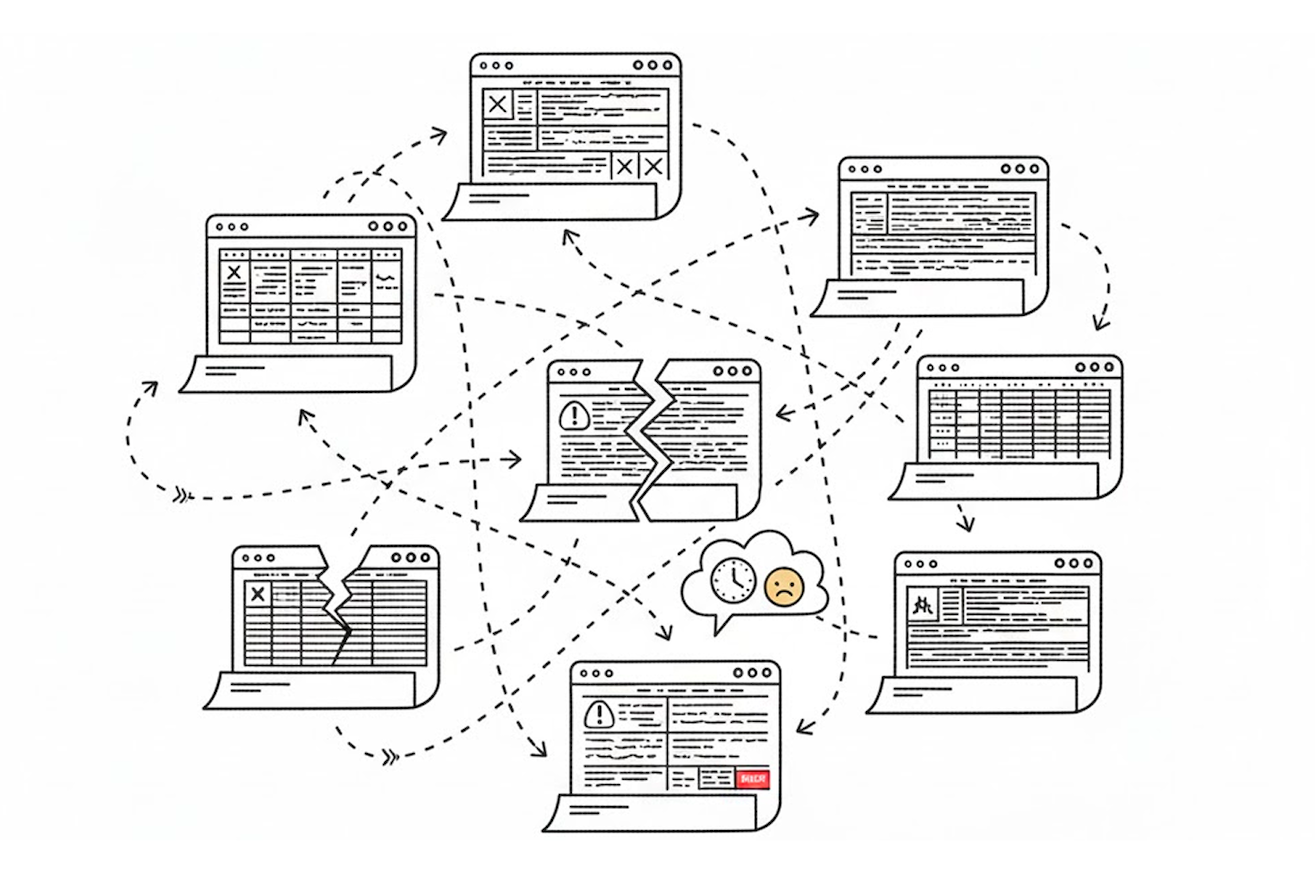

The status quo in startup finance is familiar because it feels workable. Revenue lives in one spreadsheet, costs in another, forecasts in a third. Different people own different files, often built at different times for different purposes. Data is manually pulled from banks, payment processors, billing tools, and payroll systems, then pasted into models. Updates tend to happen monthly or quarterly because doing them more often is simply too painful.

When numbers do not match, the team does what it always does: reconcile until they line up. This process creates the illusion of control, but it hides a growing cost.

The first cost is time. Highly paid finance staff spend hours copying data, checking formulas, and chasing discrepancies. This work does not improve understanding; it only keeps the system running.

The second cost is error. Every manual step introduces risk. A misplaced decimal, a broken formula, or a stale assumption can quietly skew results, often without immediate detection.

The third cost is delay. Insight arrives late because it depends on manual preparation. Decisions are made using last month’s numbers, even though the business has already changed.

The fourth cost is trust. When different reports show different answers to the same question, confidence in the numbers erodes. Teams stop debating strategy and start debating which spreadsheet is right.

At very small scale, these issues are manageable. As the business grows in complexity, they harden into structural weaknesses that slow the company down.

Failure modes (what actually breaks in practice)

These problems are not abstract. They appear in predictable ways across growing startups.

Version drift happens when multiple versions of the same spreadsheet circulate. Each is marked “final,” but each contains different assumptions. Meetings become exercises in alignment rather than decision-making.

Silent assumptions creep in when key drivers change without being documented. A growth rate, churn assumption, or hiring plan is updated, but the reasoning is not. Weeks later, no one remembers why the model behaves the way it does.

Manual reconciliation loops emerge as the business scales. Teams spend days or weeks tying numbers between systems, reports, and spreadsheets. Analysis is postponed until the mechanics are complete.

Broken formulas and links occur when models grow organically. A small edit in one place quietly invalidates logic elsewhere. The model still runs, but its output is no longer reliable.

No audit trail means changes are invisible. When a number looks wrong, there is no clear record of who changed it, when it changed, or what the previous value was.

Delayed insight becomes the norm. Reports explain what happened last month rather than what is likely to happen next. Finance becomes descriptive instead of predictive.

Overloaded analysts spend most of their time maintaining the system rather than advising the business. Their judgement is underused because their attention is consumed by data hygiene.

Each of these failures is observable, repeatable, and expensive.

Why it fails (root causes)

These failures are not caused by poor discipline or weak teams. They are a result of how the tools and workflows are structured.

Spreadsheets are designed for flexibility, not control. They work well for individual analysis but assume a single user and informal processes. Once multiple people rely on them, coordination breaks down.

Manual workflows do not scale. Copying and pasting data feels manageable at low volume, but risk grows with every additional data source, model, and reporting cycle.

Incentives favour speed of delivery over robustness. Teams are rewarded for producing numbers quickly, not for ensuring those numbers are reproducible, traceable, or explainable.

Finance is often treated as a reporting function. Insight is expected at the end of the process, after the mechanics are complete, instead of being embedded into the system itself.

As the business grows, these constraints collide and amplify each other.

The better model (the fix)

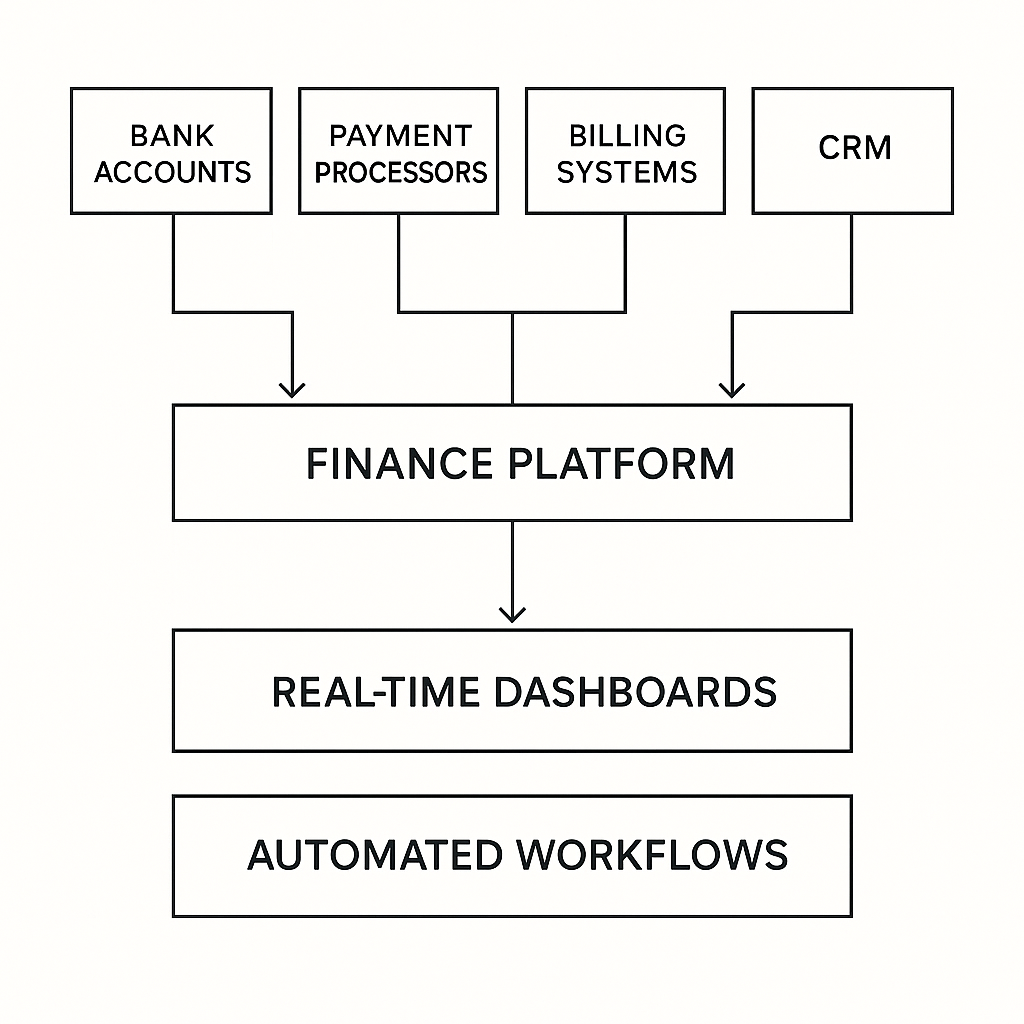

The solution is not to abandon spreadsheets entirely or to replace judgement with automation. It is to clearly separate what systems should do from what humans should do.

Systems are well suited to tasks that are repetitive and rules-based. They should ingest data directly from banks, billing platforms, payroll systems, and sales tools. They should categorise transactions consistently, maintain version control, enforce access permissions, and recalculate scenarios automatically when inputs change.

Humans should focus on work that requires context and judgement. They define assumptions, design business logic, interpret results, challenge scenarios, and make decisions where trade-offs matter. They review and approve outputs that carry real risk.

A better finance model follows a few simple principles. There is a single source of truth rather than competing files. Outputs are reproducible, meaning the same inputs always produce the same results. Assumptions are explicit rather than implicit. Audit trails are built in by default. Automation is used where risk is low, and human review is required where stakes are high. Ownership of models and outcomes is always clear.

This shift turns finance from reactive cleanup into proactive guidance.

A simple illustrative example

Consider a common question: can the company afford to hire three engineers next quarter?

Under the old approach, someone updates a spreadsheet. Payroll and runway tabs are adjusted manually. When the numbers look odd, the team reconciles them against other reports. A decision is made days later, often using data that is already outdated.

Under a better approach, the inputs are clear and current: cash on hand, existing payroll, and expected revenue growth. The system automatically updates cash flow and runway. A scenario compares hiring immediately versus delaying by three months. The output shows the impact on runway and the timing of break-even. A human reviews the assumptions and makes the decision.

The question is the same. The process is shorter. The risk is clearer.

What this unlocks (benefits with specificity)

Decisions become faster because scenarios update in minutes rather than weeks. Errors fall sharply because manual entry and fragile formulas are removed from the critical path. Accountability improves because every number has an owner and a history.

Teams gain proactive insight. Instead of discovering problems after the fact, they see trends and risks forming. Collaboration improves because finance, product, and growth teams work from the same underlying data. Trust increases because investors and boards receive consistent, explainable answers rather than reconciled surprises.

These are not abstract benefits. They are the practical outcomes of treating finance as a decision system rather than a collection of spreadsheets.

What a fully intelligent finance stack will look like in the next decade

Imagine a stack where:

- Bank, payment, billing, CRM and HR systems feed automatically into a unified data layer.

- Forecasting is live and driver-based—changing a sales metric instantly updates cash-flow, burn-rate and runway.

- AI detects anomalies, suggests corrective options and surfaces scenario risks to the CFO before they manifest.

- Collaboration happens in-system: finance, operations, growth teams work in the same environment.

- Version control and audit-ready trails are baked-in, removing fear from investor queries. This is not science fiction: for example, platforms like Cube Software integrate spreadsheet familiarity with live FP&A capabilities. Startups that invest early will build strategic advantage.

Preparing your organisation for continuous transformation

Transformation is not a one-time project, it must be continuous. Founders and finance leaders should:

- Audit current workflows and identify high-friction processes.

- Prioritise quick wins (e.g., automatic bank-feed ingestion) and build momentum.

- Plan for modular growth: adopt systems that scale, rather than ripping and replacing every few years.

- Invest in culture and capability: tools matter less than the mindset of analytical, proactive finance.

- Review vendor, security and data-governance frameworks as core infrastructure. In an era of unprecedented uncertainty and competitive velocity, finance functions that can flex, adapt and anticipate will lead.

Wrapping up

Spreadsheets did not fail startups. Startups outgrew what spreadsheets were designed to do. Treating finance as a collection of files turns decision-making into a lagging activity. Treating finance as a connected, governed system turns it into an advantage.

The goal is not to remove humans from finance. It is to remove unnecessary friction so human judgement can operate where it matters most.

Rules of thumb

- If finance feels slow, it probably is.

- If two reports disagree, the system is broken.

- If analysts are reconciling, insight is being delayed.

- Automate mechanics before adding complexity.

- Demand explainability, not just outputs.

What to do next this week

- Map where your financial data actually comes from.

- Identify one manual process to automate safely.

- Document the assumptions behind your main forecast.

- Decide who owns each model and metric.

- Review how long it takes to answer a simple financial question.

That is how finance moves from spreadsheets to intelligence.